AAre You Ready To

Unchain

Your Dollars?

Join us LIVE for a free educational workshop introducing time-tested financial principles that are often overlooked in traditional financial education. You'll get to explore approaches that have been designed to help you manage debt more efficiently while building greater financial flexibility.

If you've ever wanted to understand how many of America's financially successful families balance debt reduction with long-term savings goals, this workshop will share examples and frameworks you can learn from.

Register Now To Reserve Your Spot!

Next Webinar: Tuesday @ 7pm EST

This webinar is for educational purposes only and is not intended for individual financial or tax advice.

First Things First

A Better Strategy For Better Results

We believe a strong financial plan begins with a simple principle: long-term wealth is nearly impossible to build while carrying unmanaged debt. Many people spend decades trying to recover from lost momentum - often without a clear framework.

In this workshop, you'll be introduced to strategies that demonstrate how individuals, families, and business owners can restructure their cash flow to aggressively reduce debt - including mortgages - while also improving liquidity and flexibility over time.

And here's the best part: these concepts are designed to work within real life. No extreme budgeting. No drastic cutbacks. No giving up the things that matter most and make life enjoyable.

That’s the idea behind unchaining your dollars.

So How Does It Work?

Start Your Journey to Financial Independence Here

Register For The Webinar

Join our next LIVE Unchained Dollar Webinar and discover how some of the most financially efficient families think differently about money:

• In about 45 minutes, you'll learn smarter ways to manage your dollars and better understand how intentional financial systems support long-term success. Once you're exposed to these new ways of thinking about money, you'll likely find that you see the world of finance though a completely different lens.

Learn The Strategy

During the live educational workshop, you'll learn:

• How to Unchain your dollars. This means empowering them to work not just harder, but smarter through intentional structure.

• Strategies commonly used to build and grow wealth that is designed to remain liquid, tax-efficient, and more resilient during periods of market volatility.

• How to intentionally create a plan that aligns your debt strategy with the life you want to live.

• Why these strategies are more commonly used by financially successful individuals and institutions, yet are rarely explained to everyday people in a clear, relatable way.

Put Your Dollars To Work

After the webinar, you'll have the opportunity to receive a personal financial analysis & plan designed to illustrate:

• A report based on your current financial picture that outlines a projected debt-reduction timeline generated by our proprietary planning software.

• How this personalized plan can support your long-term financial positioning (think savings & liquidity) during and after reducing your debt obligations.

• Areas where additional cash flow and budget flexibility could be freed up.

• The analysis & report will be generated at no cost for those who attend the webinar live.

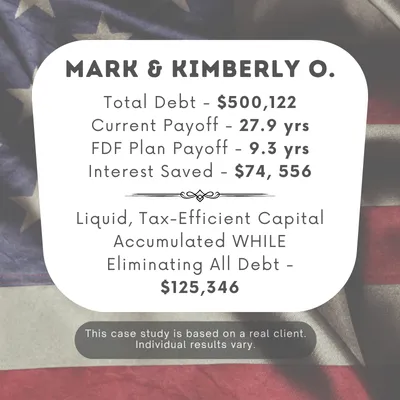

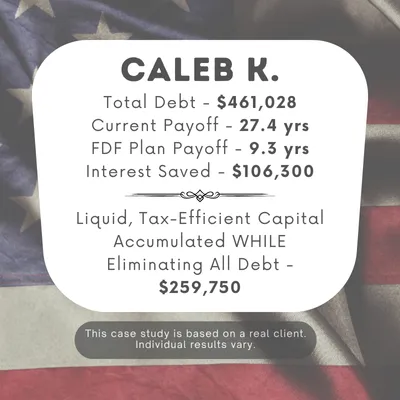

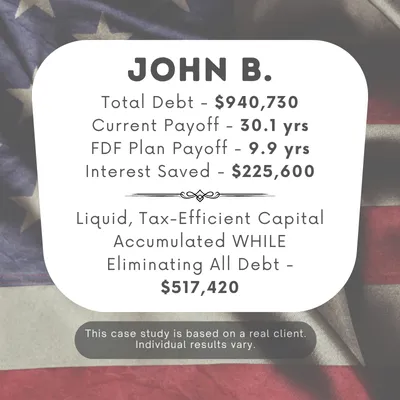

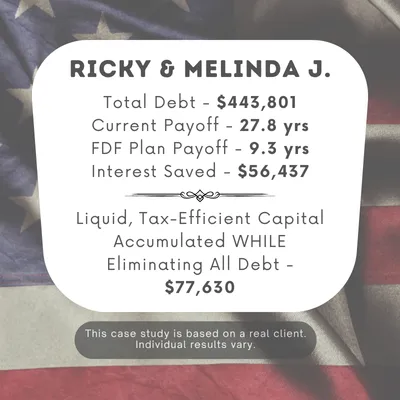

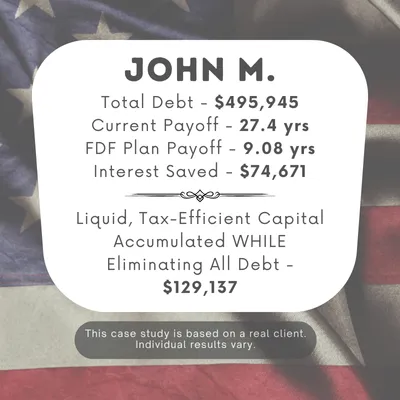

See What Could Happen When You Unchain Your Dollars

Meet The Presenters

Jeff Brummett

Jeff is an Amazon #1 best-selling author, public speaker, popular radio talk show host and a 30-year executive management leader, and Founder/President of a prestigious two-time Inc. 500 Company. Jeff is also a highly sought after public speaker/educator in the fields of debt elimination, retirement planning, and wealth management.

Tommy Kovatch

With a robust background in finance, Tommy has structured, negotiated, & secured hundreds of millions in transactions, spanning debt & equity financing, asset-based credit lines, real estate, equipment financing, structured finance, & investment banking. As a consultant, Tommy has guided clients & companies by providing expertise in strategic and financial planning, market research & validation, business & product development, resource allocation, enterprise risk management (ERM), customer relationship management (CRM), mentoring, training, & forcasting.

Frequently Asked Questions

What will I learn in the webinar?

You’ll discover ways to think about and structure your dollars more efficiently, with a focus on two things: improving debt reduction efficiency and building liquid, tax-efficient savings over time. The webinar walks through frameworks commonly used by large financial institutions, explained in a practical way that everyday families and business owners can understand and apply.

How long is the webinar?

The session lasts about 45 - 60 minutes. It's designed to be engaging, fast-paced, and packed with education you can use right away.

Does it cost anything to attend?

No - the webinar is completely free to attend. All you need to do is get registered to reserve your spot.

Do I have to share my financial information?

No, we do not ask for your financial information to register for or attend the webinar, the session is purely educational. You'll learn key concepts and see examples without needing to provide personal details. If you want a more personalized plan afterward, you'll have the option to schedule a private consultation.

Who is this webinar for?

Anyone who wants to discover strategies for using the dollars they’re working hard to earn in a smarter and more efficient way, with a focus on improving how money is structured and utilized across multiple financial priorities — such as reducing debt and building long-term wealth.

What if I can't attend live?

This is a live, interactive workshop and is not available on-demand. To receive the full experience and access to the optional personal analysis, you must attend the session live. If the scheduled time doesn’t work for you, you’re welcome to register for a future live session.

Educational webinar. Individual results vary. No cost, no obligation.

All content, materials, and concepts presented in The Unchained Dollar webinar and on this website are proprietary and protected under copyright. If you are a financial professional reviewing this information, please respect these intellectual property rights. To explore legitimate partnership or affiliate opportunities, contact us directly.

© 2025 The Unchained Dollar™ | All Rights Reserved

Use of this site and registration for any webinar constitutes your agreement to our Privacy Policy and Terms of Use. We collect basic contact information to confirm registrations, send email & SMS reminders, and share related educational content. We do not sell personal information and only use trusted third-party services to deliver secure communications. You may unsubscribe from future messages at any time by following the instructions in our emails or texts.

© 2025 The Unchained Dollar™ | All Rights Reserved

Are You Ready To

Unchain

Your Dollars?

Join us LIVE for a free educational workshop introducing time-tested financial principles that are often overlooked in traditional financial education. You'll get to explore approaches that have been designed to help you manage debt more efficiently while building greater financial flexibility.

If you've ever wanted to understand how many of America's financially successful families balance debt reduction with long-term savings goals, this workshop will share examples and frameworks you can learn from.

Register Now To Reserve Your Spot!

Next Webinar: Tuesday @ 7pm EST

This webinar is for educational purposes only and is not intended for individual financial or tax advice.

First Things First

A Better Strategy For Better Results

We believe a strong financial plan begins with a simple principle: long-term wealth is nearly impossible to build while carrying unmanaged debt. Many people spend decades trying to recover from lost momentum - often without a clear framework.

In this workshop, you'll be introduced to strategies that demonstrate how individuals, families, and business owners can restructure their cash flow to aggressively reduce debt - including mortgages - while also improving liquidity and flexibility over time.

And here's the best part: these concepts are designed to work within real life. No extreme budgeting. No drastic cutbacks. No giving up the things that matter most and make life enjoyable.

That’s the idea behind unchaining your dollars.

So How Does It Work?

Start Your Journey To Financial Independence Today

Register For The Webinar

Join our next LIVE Unchained Dollar Webinar and discover how some of the most financially efficient families think differently about money:

• In about 45 minutes, you'll learn smarter ways to manage your dollars and better understand how intentional financial systems support long-term success. Once you're exposed to these new ways of thinking about money, you'll likely find that you see the world of finance though a completely different lens.

Learn The Strategy

During the live educational workshop, you'll learn:

• How to Unchain your dollars. This means empowering them to work not just harder, but smarter through intentional structure.

• Strategies commonly used to build and grow wealth that is designed to remain liquid, tax-efficient, and more resilient during periods of market volatility.

• How to intentionally create a plan that aligns your debt strategy with the life you want to live.

• Why these strategies are more commonly used by financially successful individuals and institutions, yet are rarely explained to everyday people in a clear, relatable way.

Put Your Dollars To Work

After the webinar, you'll have the opportunity to receive a personal financial analysis & plan designed to illustrate:

• A report based on your current financial picture that outlines a projected debt-reduction timeline generated by our proprietary planning software.

• How this personalized plan can support your long-term financial positioning (think savings & liquidity) during and after reducing your debt obligations.

• Areas where additional cash flow and budget flexibility could be freed up.

• The analysis & report will be generated at no cost for those who attend the webinar live.

See What Could Happen When You Unchain Your Dollars

Meet The Presenters

Jeff Brummett

Jeff is an Amazon #1 best-selling author, public speaker, popular radio talk show host and a 30-year executive management leader, and Founder/President of a prestigious two-time Inc. 500 Company. Jeff is also a highly sought after public speaker/educator in the fields of debt elimination, retirement planning, and wealth management.

Tommy Kovatch

With a robust background in finance, Tommy has structured, negotiated, and secured hundreds of millions in transactions, spanning debt and equity financing, asset-based credit lines, real estate, equipment financing, structured finance, and investment banking. As a consultant, Tommy has guided client companies by leading operations and providing expertise in strategic and financial planning, market research and validation, business and product development, resource allocation, enterprise risk management (ERM), customer relationship management (CRM), mentoring, training, and forecasting.

Frequently Asked Questions

What will I learn in the webinar?

You’ll discover ways to think about and structure your dollars more efficiently, with a focus on two things: improving debt reduction efficiency and building liquid, tax-efficient savings over time. The webinar walks through frameworks commonly used by large financial institutions, explained in a practical way that everyday families and business owners can understand and apply.

How long is the webinar?

The session lasts about 45 - 60 minutes. It's designed to be engaging, fast-paced, and packed with education you can use right away.

Does it cost anything to attend?

No - the webinar is completely free to attend. All you need to do is get registered to reserve your spot.

Do I have to share my financial information?

No, we do not ask for your financial information to register for or attend the webinar, the session is purely educational. You'll learn key concepts and see examples without needing to provide personal details. If you want a more personalized plan afterward, you'll have the option to schedule a private consultation.

Who is this webinar for?

Anyone who wants to discover strategies for using the dollars they’re working hard to earn in a smarter and more efficient way, with a focus on improving how money is structured and utilized across multiple financial priorities — such as reducing debt and building long-term wealth.

What if I can't attend live?

This is a live, interactive workshop and is not available on-demand. To receive the full experience and access to the optional personal analysis, you must attend the session live. If the scheduled time doesn’t work for you, you’re welcome to register for a future live session.

Educational webinar. Individual results vary. No cost, no obligation.

All content, materials, and concepts presented in The Unchained Dollar webinar and on this website are proprietary and protected under copyright. If you are a financial professional reviewing this information, please respect these intellectual property rights. To explore legitimate partnership or affiliate opportunities, contact us directly.

© 2025 The Unchained Dollar™ | All Rights Reserved

Use of this site and registration for any webinar constitutes your agreement to our Privacy Policy and Terms of Use. We collect basic contact information to confirm registrations, send reminders, and share related educational content. We do not sell personal information and only use trusted third-party services to deliver secure communications. You may unsubscribe from future messages at any time by following the instructions in our emails or texts.